China is the only major economy dealing with deflation

Beijing is staring down negative consumer prices as well as a real estate meltdown, uber-bearish investors, and weak consumer confidence.

REUTERS/Aly Song

- China has been grappling with negative consumer prices for several months.

- No other major world economy faces deflation.

- China's deflation problem comes amid a property market meltdown, extreme bearishness, and weak consumer confidence.

Deflation was unique to China in 2023, and that remains the case two months into the new year as the country grapples with slumping demand as a result of its dire real estate crisis and broader economic malaise.

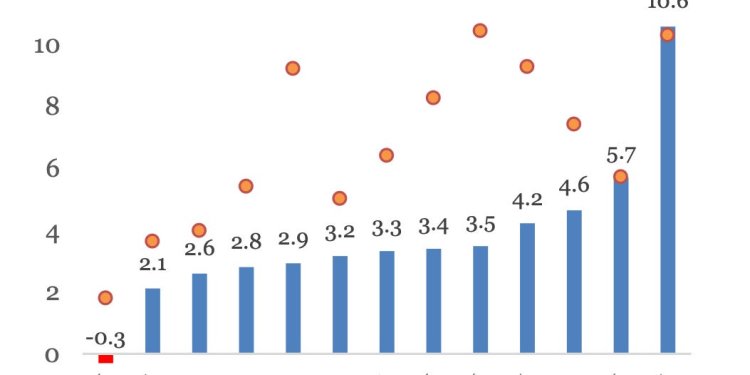

China is the only major economy with negative consumer prices, dropping 0.8% year-over-year in January. That marked the fourth consecutive month of declines and the steepest drop in 15 years. IIF

Some economists have noted that the sharp dip could be chalked up to seasonal factors, but even so, the trend has been ongoing. Deflation is weighing on household incomes, corporate earnings, and government taxes — and in the IIF's view, Beijing has a challenging road ahead to engineer a rebound.

To that point, China's core CPI has been under 1% for the last 22 months. The country's GDP deflator, a wide measure of domestic prices, clocked in at -0.5% year-over-year for 2023, suggesting that deflation is broad-based.

"Industrial overcapacity and real estate recession are the culprits of deflation," IIF economists wrote in a note on February 28, adding that the former explains why goods prices have plunged more than services.

And China's ongoing real estate market slump has depressed the prices for household items and residences. Home sales dropped 6.5% last year, and dragged the prices of home appliances, furniture, and home improvement goods, according to the IIF.

"Once the expectation for further deflation is formed, consumers and investors will cut back on their spending," IIF economists said. "Deflation will reduce the nominal GDP and thus raise the debt/GDP ratio and exacerbate the debt overhang. The falling asset prices and negative wealth effect are hurting investment and consumption."

What's Your Reaction?