A former US surgeon general went to the ER for dehydration and ended up with a $5,000 bill. He called healthcare a 'broken system.'

Former US Surgeon General Jerome Adams said he got a $5,000 bill for a recent ER visit, highlighting big problems with the US healthcare system.

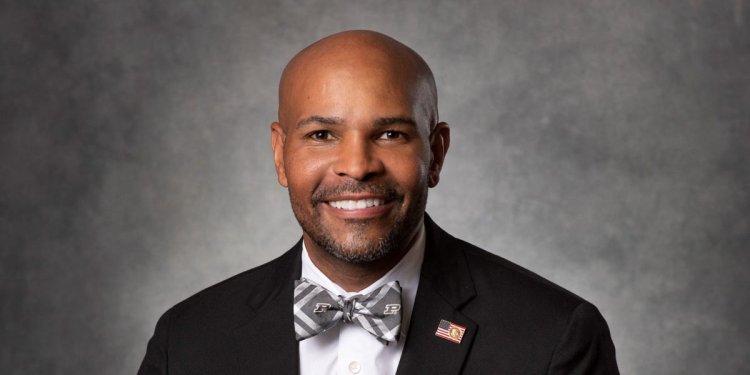

John Underwood

- Former US Surgeon General Jerome Adams said he got a $5,000 bill for a recent ER visit.

- He's fighting the bill, which he said has been "mentally taxing."

- His experience highlights big problems with US healthcare, including high costs and no transparency.

The former US surgeon general just got a taste of what's frustrated countless Americans: a massive medical bill.

Dr. Jerome Adams, who was the nation's top doctor from 2017 to 2021, said he was slammed with an almost $5,000 bill after being treated for dehydration at the Mayo Clinic's emergency department, where he got labs and a few IV bags. He first shared his experience on X (formerly Twitter) in a post that went viral.

In an interview Monday with Business Insider, Adams said he had gone to the ER in Scottsdale, Arizona, after he went hiking during a work trip in January and became lightheaded. Getting the big bill was shocking—even for a doctor well-acquainted with the pitfalls of US healthcare system. He said spending hours on the phone with hospital billing reps to get a clearer picture of why he was charged so much has been "mentally taxing."

The Mayo Clinic did not immediately return a request for comment.

Adams said his experience highlights the exorbitant cost of medical care in the US and the lack of price transparency. Patients usually have no idea what a medical visit will cost ahead of time, and even if they did, it's impossible to shop around in an emergency. At the same time, patients increasingly shoulder a larger portion of healthcare costs as insurance deductibles have crept higher.

Adams said with all these obstacles, it's no wonder many Americans end up with medical debt.

"If I'm in this situation with my knowledge and with my financial resources and with my bully pulpit, then the average Joe doesn't stand a chance. The system is just broken," Adams said.

Adams' big medical bill

Medical debt is a widespread problem. An estimated 20 million people in the US owe medical debt, and 14 million people owe $1,000 or more, according to an analysis by the Kaiser Family Foundation and the Peterson Center on Healthcare. Research has shown that medical debt is a leading cause of personal bankruptcy.

It's unclear why Adams' bill was so high since he said he hasn't received a breakdown of the charges. ER bills are notoriously expensive and can vary drastically from hospital to hospital.

Adams said he was billed for a Level 5 visit, which is a code used for patients with the highest level of severity, such as chest pain or stroke symptoms. The most complex cases fetch higher payments because they require more resources and time. But Adams is fighting the bill because he believes his visit should have been coded at a lower level.

Another issue is that Adams is enrolled in a high-deductible health plan, requiring him to pay thousands of dollars out of pocket before he reaches the "deductible" and insurance starts picking up part of the tab.

High-deductible plans have become more common as employers have shifted the cost of medical care to their workers. The average annual deductible for individuals in one of these plans attached to a health-savings account was $2,518 in 2023, according to the Kaiser Family Foundation. Adams said his deductible is a whopping $7,500.

The health plans allow patients to put pre-tax money in a savings account each month to help them afford their medical bills. But since Adams' ER visit occurred in January, he hadn't built up any savings, he said.

Patients need more clarity on big medical bills

Congress has provided some relief from unexpected medical bills. The No Surprises Act, which went into effect in 2022, is supposed to keep patients from getting stuck with a surprise bill if they inadvertently receive care from an out-of-network doctor.

But Adams said patients should have a better sense of what they'll be required to pay ahead of getting care and more clarity about their options when they get a big bill. Furthermore, he said patients shouldn't face drastically different costs for the same care at different facilities.

"People are so scared of these bills due to lack of transparency. They actually just don't go in at all until it truly does become an emergency," he said.

The ER visit isn't Adams' first brush with an unexpected bill, and he fears it won't be the last. He said the Mayo Clinic's billing department warned him that he might receive another bill for his ambulance ride to the hospital.

He's fortunate enough to be able to swing these bills if he has to, he said. That's not the case for many others.

"There are many flaws in the system that would've caused other individuals to have gone into debt, have their credit ruined, or have to make choices about things they needed to do," Adams said. "I've got three high schoolers, two kids heading to college. If I wasn't in my income bracket, I might be making a choice as to whether or not to pay my medical bill or to pay my kid's tuition."

What's Your Reaction?