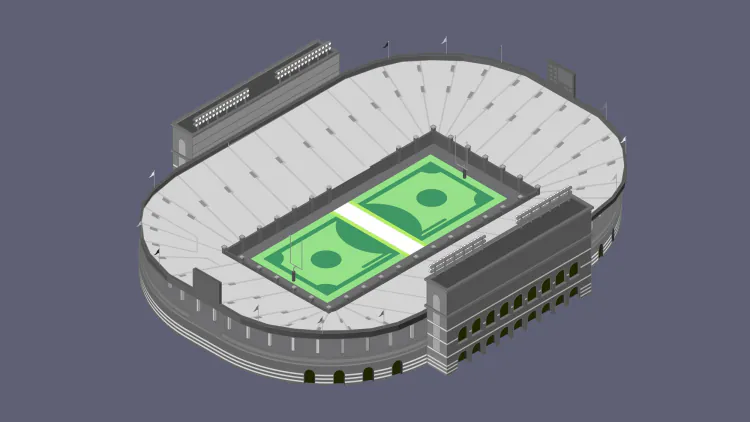

Stadium Subsidies Are Getting Even More Ridiculous

You would think that three decades’ worth of evidence would put an end to giving taxpayer money to wealthy sports owners. Unfortunately, you would be wrong.

Open a map of the United States. Select a big city at random. Chances are, it has recently approved or is on the verge of approving a lavish, taxpayer-funded stadium project for one or more of its local sports teams. This is true in Las Vegas, where the team currently known as the Oakland Athletics will soon be playing in a new ballpark up the street from the home of the NFL’s Raiders, also formerly of Oakland. Combined, the two stadiums will end up receiving more than $1.1 billion in public funding, not counting tax breaks. Something similar is happening in Chicago, where Jerry Reinsdorf, owner of the White Sox, wants roughly $1 billion in public funding for a new stadium in the South Loop, while the Halas-McCaskey family, which owns the Bears, is requesting $2.4 billion for a new football stadium on the lakefront. Likewise in Cleveland, which has one of the nation’s highest childhood poverty rates, as well as in Phoenix, Philadelphia, and St. Louis. In Buffalo, the Bills recently received $850 million for new digs, and in Nashville, politicians approved a record $1.26 billion subsidy for the Titans.

Economic research is unequivocal: These subsidies are a boondoggle for taxpayers, who have spent nearly $30 billion on stadiums over the past 34 years, not counting property-tax exemptions or federal revenues lost to tax-exempt municipal bonds. Stadiums do not come close to generating enough economic activity to pay back the public investment involved in building them—especially when they’re coupled with lease agreements that funnel revenue back to owners or allow teams to play in the stadiums rent-free. Even as an investment in your city’s stores of community spirit, stadium subsidies at this price are hard to justify. As the economist J. C. Bradbury told the Associated Press, “When you ask economists if we should fund sports stadiums, they can’t say ‘no’ fast enough.”

[Read: Sports stadiums are a bad deal for cities]

You would think that three decades’ worth of evidence would be enough to put an end to the practice of subsidizing sports stadiums. Unfortunately, you would be wrong. America finds itself on the brink of the biggest, most expensive publicly-funded-stadium boom ever, and the results will not be any better this time around.

Until the 1980s, super-rich sports franchise owners generally did not seek or receive extravagant public subsidies. Three events changed that. First, in 1982, Al Davis, the Raiders’ owner, left Oakland for Los Angeles because officials refused to fund renovations to the Oakland Coliseum, which the city had built in the ’60s. (They would later cave on this; the Raiders returned to Oakland in 1995, lured by public funds.) Second, in 1984, Robert Irsay, the owner of the Baltimore Colts, moved the team to Indiana after being offered a sweetheart deal at the publicly funded Hoosier Dome. Finally, a few years later, Maryland approved hundreds of millions of dollars in public funding—along with a historically lopsided lease agreement—for a new stadium for the Orioles, now Baltimore’s only remaining team. “If you want to save the Orioles,” Maryland House Speaker R. Clayton Mitchell said at the time, “you have to give them this kind of lease.”

Camden Yards turned out to be beautiful—a downtown shrine of hand-laid brick and cast-iron gates that evoked the odd-angled “Golden Age” of American ballpark design. Major League Baseball, sportswriters, and obliging local politicians were also quick to credit Camden Yards with spurring a revival of Baltimore’s downtown—and, with it, of inspired downtowns elsewhere. “No longer would communities across America build stadiums devoid of character,” Major League Baseball mythologized in a press release celebrating the park’s 30th anniversary, “but instead would build them to flow seamlessly in existing and historic neighborhoods, playing key roles in the revitalization of urban America.” This turned out to be a trap; now politicians could convince themselves that capitulating to team owners was sound public policy. Never mind that, in Baltimore’s case, Camden ultimately didn’t do all that much reviving. (The neighborhoods surrounding Camden Yards actually shed employers in the decades after the park opened, while unemployment and crime rose, according to Bloomberg.) Owners have made the idea central to the way they sell stadium projects ever since.

In the early ’90s, for example, boosters pitched Cleveland’s Jacobs Field in a newspaper ad that promised “$33.7 million in public revenues every year” along with “28,000 good-paying jobs for the jobless” and “$15 million a year for schools for our children.” Now, here’s how Dave Kaval, president of the Oakland A’s, described the benefits of the $855 million subsidy that the A’s were trying to extract from Oakland, in 2021, before the team decided to relocate to Las Vegas: “Seven billion dollars in economic impact. 6,000 permanent and mostly union jobs. 3,000 construction jobs. We’re building more than a ballpark here.”

[Read: Stadiums have gotten downright dystopian]

Stadiums don’t actually do these things. The jobs they create are seasonal and low-wage. They tend not to increase commercial property values or encourage much in the way of economic activity, besides a bit of increased spending in bars and restaurants surrounding the venue—which is mostly being substituted for dollars that were previously being spent elsewhere. Tax revenues attributable to stadiums fall well short of recouping the public’s investment. Economically speaking, stadium subsidies mostly just transfer wealth from taxpayers to the owners of sports franchises.

This became clear to economists early into the previous subsidy boom. For a time, cities and states appeared to have wised up. Taxpayers covered 68 percent of the costs of major sports venues built or renovated between 1992 and 2008, but only 31 percent of the costs from 2009 to 2020, according to research that Victor Matheson, an economist at the College of Holy Cross, shared with The Athletic. Unfortunately, this turned out to be just a lull. Team owners tend to demand stadium upgrades at the end of their leases, which typically last 30 years. Camden Yards, which spurred the last subsidy boom, was built 32 years ago. We are merely reentering stadium-subsidy season.

This time, the costs promise to be even higher, the consequences even more depressing. As the expense of stadium construction has gone up, so has the size of the subsidies owners ask for—along with the shamelessness and determination with which they seek them out. That’s one reason so many teams have threatened to relocate in just the past few months. The American major leagues are all more profitable than they’ve ever been—Major League Baseball alone made a record $11.6 billion in 2023, the NFL $19 billion—while individual teams are more valuable, thanks in part to subsidies. As Matheson told me in 2022, “Any time a team gets a new stadium, you immediately see its valuation rise.”

The situation presents a classic collective-action problem. American cities would all be better off if stadium subsidies disappeared. But individual political leaders seem to be afraid to buck the trend unilaterally, lest they be blamed for the departure of a beloved franchise.

The obvious solution is federal legislation. A good start would be to reverse the existing, obscure statutory provision that helped make the stadium-subsidy cycle possible. Congress made interest on municipal bonds tax-exempt in 1913 in order to encourage public infrastructure spending. The intention was not to finance private construction, and in the 1986 Tax Reform Act, Congress tried to cut off that form of misappropriation. What the law should have done was simply revoke access to tax-exempt bonds for use on private projects, such as stadiums. Instead, it left a loophole. It enabled state and local governments to issue tax-exempt bonds for private projects as long as they finance at least 90 percent of the cost of the project themselves and pay no more than 10 percent of the debt service using revenues generated by the project. Essentially, a city could access the bonds only if it was willing to drain its own funds for the benefit of sports-franchise owners. The assumption was that no city would be stupid enough to accept such a bad bargain—but that assumption turned out to be deeply mistaken. Lawmakers have introduced bills seeking to correct the oversight several times over the years, but none has become law.

In the meantime, change is up to sports fans. As beloved as sports are in America, socializing stadium construction remains unpopular. Indeed, when stadium subsidies are put to voters, many of them fail, as a referendum on a sales-tax extension to pay for new stadiums for the Chiefs and Royals recently did in Kansas City. Some groups, such as the Coalition to Stop the Arena at Potomac Yard, which organized against a proposed $1.5 billion subsidy for Ted Leonsis, the owner of the Washington Wizards and Washington Capitals, have recently even managed to stop subsidized projects before that point. “Teams need a place to play, and if local governments told them to pay a fair rent or go pound sand, owners would have little choice but to go along,” Neil deMause, a co-author of Field of Schemes: How the Great Stadium Swindle Turns Public Money Into Private Profit, told me.

[Matt Connolly: Enjoy your awful basketball team, Virginia]

Telling owners to pound sand, however, would require cities, and fans, to call a billionaire’s bluff. That is no small thing. Teams don’t usually relocate, but when they do, it’s painful; as an Oakland sports fan, I know this from experience. I empathize with the impulse to tell politicians to do whatever it takes to keep a team. Especially when I think of all the A’s games I won’t be able to take my son to.

But “whatever it takes” is an untenable stance, especially when the bill from last time has not yet fully been paid, and the likelihood of a return on the investment is so demonstrably dubious. In Alameda County, where I live, taxpayers are still paying off the debt issued to renovate the Oakland Coliseum in 1995. When the tab is finally settled, the subsidy will have cost us $350 million, paid for mostly out of the general fund. In that time, Oakland has contended with several historic budget shortfalls and struggled to address its competing crises, including homelessness and rising crime. Giving $855 million to John Fisher, the A’s owner, would not have solved these problems. The evidence suggests, in fact, that it would have only made things worse. One wonders how much more evidence will have accumulated 30 years from now, when the next subsidy boom threatens to begin.

What's Your Reaction?