Nvidia's AI chips boom could help the Biden administration bring semiconductor jobs to the US

Surging demand for Nvidia's AI chips could spur job growth across the US semiconductor industry.

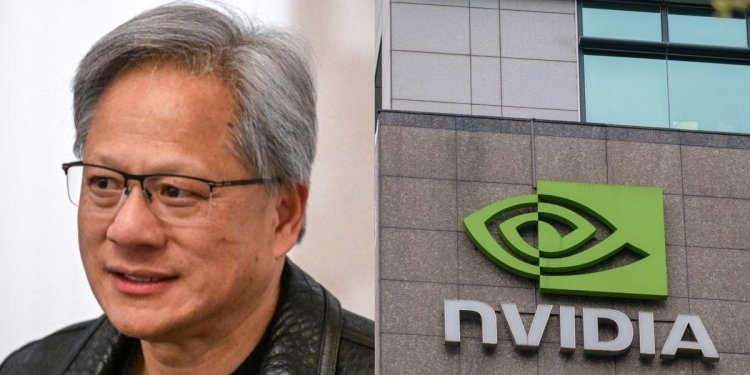

Mohd Rasfan/AFP/Getty Images (Left), Walid Berrazeg/SOPA Images/LightRocket via Getty Images (Right)

- The demand for Nvidia's AI chips could bolster job growth across the semiconductor industry.

- That's because tech companies need more than just Nvidia's high-end chips to build their AI technologies.

- While Nvidia and TSMC remain the leaders in the AI chips sector, many companies are also making investments.

Nvidia's stockholders aren't the only ones who have reason to celebrate the company's smashing success over the past year.

Surging demand for the company's high-end chips — used to power AI technologies like ChatGPT — could help create jobs for chip designers, manufacturers, and suppliers across the semiconductor industry.

It could also help the Biden administration bring more semiconductor chip manufacturing stateside and reduce the US's reliance on Taiwan — which remains vulnerable to Chinese invasion that would wreak havoc on the global economy. In 2022, President Joe Biden signed the CHIPS Act into law, which included $52 billion in subsidies designed to bolster the US semiconductor industry.

In January, Deloitte projected that global semiconductor chip sales, led by AI chips, would grow 13% in 2024 to the highest level on record. The market for AI chips has grown from close to zero in 2022 to a projected $50 billion in 2024, and by 2027, it could account for half of the entire chip market. Even many optimistic industry projections of the past now seem far too conservative, Intel's CEO Pat Gelsinger recently told reporters.

Even without the AI boom, the semiconductor industry was already poised for big job gains in the near future. The US government had plans to invest billions of dollars to bring the production of chips that power things like iPhones, pickup trucks, and washing machines back to the US. In a July 2023 report, the Semiconductor Industry Association projected that the industry's US workforce would grow by nearly 115,000 by 2030.

But a variety of roadblocks have delayed this rosy future from becoming a reality. In 2023, the historically cyclical semiconductor industry saw sales fall nearly 10%, which caused many companies to scale back their near-term hiring and lay off workers. Additionally, some major US chip factories have faced construction delays, and the rollout of government funds to support investment has been slow. It's left some people who've been trained to work in the industry wondering when all the promised jobs are coming.

Now, it appears the buzz around generative AI — and the surging demand for chips that power it — is turning things around. This could benefit a variety of US companies in the chip production supply chain, provide more jobs for Americans, and help the US bring chip production closer to home.

Which companies will create jobs due to the AI chip boom?

Nvidia is the leading designer and seller of H100 GPUs — the key chips companies use to train and deploy AI models. In February, the company reported over $22 billion in revenue for the fourth quarter of 2023 and became the third most valuable US corporation.

Unlike some semiconductor companies, Nvidia doesn't manufacture any of its own chips. Most of Nvidia's high-end chip production is done by TSMC at its Taiwan-based factories, industry experts told Business Insider. The Taiwan-based company is the world's largest chip manufacturer and one of the companies currently building plants in the US.

While Nvidia and TSMC are the dominant players in the AI chips space, other companies could also benefit from the chips boom. That's because tech companies need a variety of chips to make their AI technologies run.

"It's not like you got the Nvidia H100 chip and your solution's complete — you need other chips," Syed Alam, global semiconductor lead at the IT services and consulting firm Accenture, told BI.

This means that many companies that buy Nvidia's high-end AI chips could also buy a wide range of other chips. This is good news for companies across the semiconductor industry — and workers who could land jobs with these companies if demand spikes.

"I anticipate that the rising demand for AI chips will continue to increase as competition heats up, and this will benefit the entire semiconductor industry," Ed Kaste, senior vice president of product management at the chipmaker GlobalFoundries, told BI.

GlobalFoundries specializes in chips that are typically used for cars and consumer appliances — but still have some use cases for AI companies.

While Nvidia is the top player in AI chip design, other companies are trying to capitalize on the growing market. These include tech companies like Amazon and Meta and established industry players like Intel and AMD.

"The generative AI boom is clearly a very good thing for Nvidia and TSMC in the lead," Mark Muro, a senior fellow at the Brookings Institution who studies the impact of AI on the economy, told BI. "But with that said, other big actors like Samsung, Intel, Google, and IBM could also benefit from the chip gold rush."

TSMC remains the predominant manufacturer of Nvidia's high-end AI chips. But Muro said that as Nvidia grows, it may diversify its manufacturing ecosystem in the years ahead — and that the US semiconductor industry could reap some of the rewards. Last year, Nvidia CEO Jensen Huang said that the company planned to manufacture some chips at TSMC's Arizona factories once they come online. The company could rely more on other chipmakers like Intel, though it hasn't confirmed any such plans.

Manufacturing some of Nvidia's high-end chips in the US wouldn't just provide a boost to the economy, but help minimize risk to American companies in the case of a Chinese invasion of Taiwan.

It's not just chip designers and manufacturers that could benefit from rising demand for AI chips.

There are also several companies, many of them based in the US, that sell specialized semiconductor equipment that companies like TSMC use to manufacture chips. Dylan Patel, a chief analyst at the semiconductor research and consulting firm SemiAnalysis, said that Lam Research, Applied Materials, and KLA Corporation are among the businesses that could benefit from rising AI chip demand.

"Expect to see a significant expansion of employee count to meet the demand for chip design and semiconductor capital equipment," he said.

Some of this job growth is already happening. Applied Materials' workforce, half of which Patel said is based in the US, grew from 22,000 employees in 2019 to 34,000 by the end of last year.

Will there be enough workers to fill semiconductor jobs?

As chip factories get more advanced, Accenture's Alam said that some processes could be automated — one factor that might offset some of the industry's job gains. But he said there should be plenty of demand for workers in the years to come.

As expectations for semiconductor job growth in the US continue to grow, one of the key questions is who will fill all these jobs. Of the 115,000 US new semiconductor jobs the Semiconductor Industry Association is projecting by 2030, it said roughly 67,000 of these positions risk going unfilled given current college degree completion rates.

Per the Semiconductor Industry Association, most of the potentially unfilled jobs are for technician and engineer roles that typically require as little as a certificate or two-year degree and as much as a master's or Ph.D. In an effort to prevent a worker shortage, community colleges and universities across the country have partnered with semiconductor companies.

"The job growth is there, and then also at the same time, there's concern whether we will be able to find the talented, skilled resources to fill these jobs," Alam said.

What's Your Reaction?