Jeff Bezos, Jamie Dimon, and Mark Zuckerberg have sold stock worth about $9 billion. They might think markets can't go much higher.

Jeff Bezos pocketed about $8.5 billion from selling stock, while Mark Zuckerberg and Jamie Dimon have each made about $400 million and $150 million.

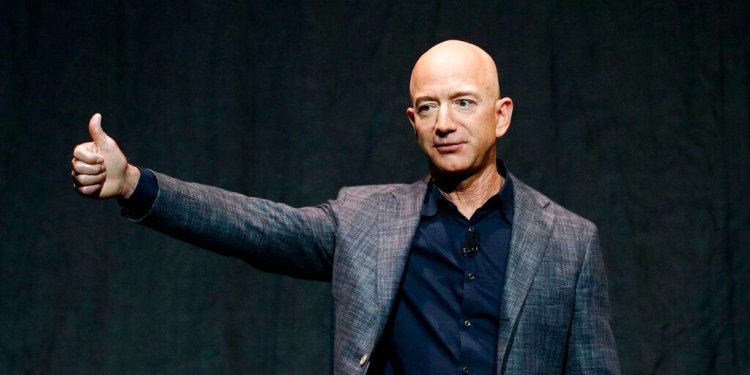

Patrick Semansky/AP

- Jeff Bezos, Jamie Dimon, and Mark Zuckerberg have all been selling shares in their companies.

- The Amazon founder and JPMorgan and Meta CEOs risk sending a worrying message to markets.

- Executives sell shares for plenty of reasons, from tax and estate planning to personal expenses.

Amazon's Jeff Bezos, JPMorgan's Jamie Dimon, and Meta's Mark Zuckerberg have all sold big chunks of shares in their own companies. How come?

Bezos is way out in front after offloading 50 million shares of Amazon in just nine trading days this month, pocketing an estimated $8.5 billion.

Zuckerberg cashed in almost 1.8 million shares of his social-media empire for more than $400 million in the last two months of 2023.

JPMorgan's Dimon joined the club this month, jettisoning about 822,000 shares of the bank he leads for about $150 million.

The sales are striking for several reasons. Dimon's disposals represent his first sales of JPMorgan stock in his 18 years as CEO.

Zuckerberg hadn't sold Meta shares for almost two years prior to his latest transactions. Bezos has gone from selling less than $3 billion of stock annually prior to 2019, to more than $3 billion in four days in early 2020, and now close to triple that figure in nine days. Brendan Smialowski/Getty Images

All the sales were conducted under trading plans announced months in advance, which executives rely on so they can sell shares without investors thinking it means they have the inside track on bad news ahead — or that the stock has hit unsustainable highs.

Yet it's certainly possible that Bezos, Zuckerberg, and Dimon decided to line up sales because their shares had ballooned in value, and cashing out was making more and more sense.

Meta stock has soared by 186% over the past year, JPMorgan is up nearly 30%, and Amazon has surged close to 90%. All three companies are trading close to record highs.

The trio might see limited upside for their stock prices from here, but corporate bosses make disposals for many reasons. For example, they might have a large tax bill coming up, or they might need cash to cover a big-ticket purchase like a mansion or superyacht.

Skin in the game

They might want to diversify their portfolio if virtually all their wealth is in one stock, or they might be rejigging their holdings as part of retirement or inheritance planning.

Still, executives are fully aware of the message it sends to markets when they sell large chunks of their company's stock. Warren Buffett has famously never sold a share of Berkshire Hathaway.

He's said that keeping more than 99% of his wealth in Berkshire stock means his interests are aligned with those of his shareholders, and that amount of "skin in the game" signals his long-term confidence in, and commitment to, his company. University of Nebraska-Lincoln

It's worth emphasizing that Bezos, Zuckerberg, and Dimon's sales only represent small fractions of their stakes, so they're still heavily invested in their respective companies' success.

But notably they haven't been buying shares, which would indicate they believe the best is yet to come, and they want more exposure to their companies in their personal portfolios.

Instead, they've been selling which risks sending the message that their shares are fully valued — and it's time to take money off the table.

What's Your Reaction?